Share:

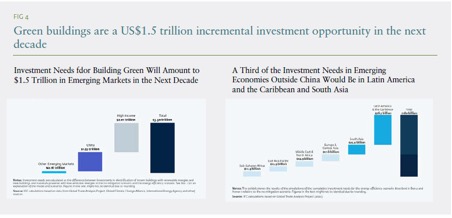

The global real estate sector is both the largest source of emissions and the greatest investment opportunity in the journey toward net-zero. According to IFC (2025), greening the construction value chain could unlock USD 1.5 trillion in investment opportunities across emerging markets in the next decade.

The global real estate sector is both the largest source of emissions and the greatest investment opportunity in the journey toward net-zero. According to IFC (2025), greening the construction value chain could unlock USD 1.5 trillion in investment opportunities across emerging markets in the next decade.

This article summarizes the key insights from Sustainable Buildings: Finance Reference Guide, analyzing the financial and commercial benefits, green finance instruments, and implementation steps in sustainable real estate—supported by case studies—to provide strategic value for developers and investors.

1. The Current Challenge

The construction sector accounts for 37% of global carbon emissions, with two-thirds originating from emerging markets.

Without a transition to sustainable building practices, climate-related and infrastructure losses could reach USD 1 trillion in the next decade.

In this context, green finance has emerged as both a driver of sustainability and a profitable investment channel for real estate developers.

2. Global Context and Investment Opportunities

-

The global real estate market was valued at USD 379.7 trillion by the end of 2022 — more than four times global GDP.

-

Investment in green buildings surged from USD 10 billion in 2017 to USD 230 billion in 2021.

-

However, only 10% of this value originated from emerging markets → representing a significant gap and opportunity for investors.

-

Greening the construction value chain could generate USD 1.5 trillion in investment opportunities in emerging markets over the next 10 years.

.

3. Financial Value for Investors

According to Chapter 3 of the Guide, the benefits include:

-

Enhanced ESG profile and increased investor confidence.

-

Reduced portfolio risk: green mortgage borrowers have a 32% lower default rate.

-

New financial products: several countries have issued their first green bonds for real estate, including Colombia and Kenya.

4. Commercial Value for Developers and Owners

(From Chapter 4 – The Commercial Value of Sustainable Buildings: Why Developers and Asset Owners Should Care)

-

Additional costs are lower than expected with early-stage planning.

-

Faster sales and higher rents due to market differentiation.

-

Reduced operational costs for both owners and tenants.

-

Access to international finance under favorable conditions.

-

Government incentives such as tax exemptions and fast-track approvals.

-

Lower legal risks and long-term asset value growth.

Example: NEPI Rockcastle (Romania) successfully raised €1 billion in green bonds and €795 million in sustainability-linked loans through a transparent green finance framework.

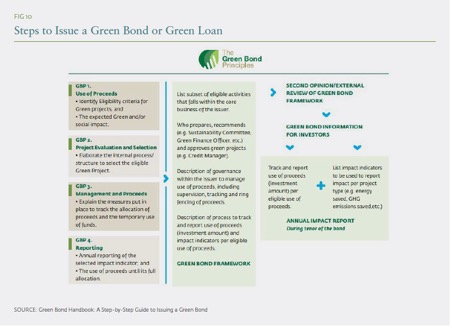

5. Green Finance Instruments

(From Chapter 2 – Taxonomies)

-

Green Bonds/Loans: directly tied to certified green buildings.

-

Sustainability-Linked Loans/Bonds: interest rates linked to sustainability KPIs.

-

Blue Finance: focused on water and marine resources.

-

Circular Economy & Nature-Based Solutions: promote recycled materials and ecological infrastructure.

6. Implementation Process

(From Chapter 5 – Steps to Create a Program)

-

Raise awareness and identify a pipeline of projects.

-

Design green financial products.

-

Engage technical experts for project evaluation.

-

Use green building certifications (EDGE, LEED, BREEAM) as proof of compliance.

-

Report impacts under international standards (ICMA, GRESB, ISSB).

7. Case Studies

-

Colombia: Green buildings account for 25% of new constructions, with over 20 million m² EDGE-certified by 2025.

-

Absa Bank (South Africa): developed the Eco Home Loan program with interest rate incentives, supported by USD 236 million in green credit from IFC.

-

FIBRA Macquarie (Mexico): secured USD 150 million in sustainability-linked financing to develop green industrial parks.

8. Conclusions and Key Takeaways

Green finance is not just a trend, but a long-term investment strategy combining environmental, social, and financial returns.

Developers should establish green finance frameworks early and adopt international certifications to improve access to capital.

Green investments help build competitive advantage, protect asset value, and unlock access to the USD 1.5 trillion funding pool available in the coming decade.

Q&A: Green Finance and Opportunities for Vietnam

Q1: Why does green real estate attract strong international investment?

A1: The global real estate market is worth nearly USD 380 trillion. IFC estimates that allocating just 0.03% of global GDP to greening the value chain could unlock USD 1.5 trillion in opportunities in emerging markets. Green buildings help investors access this capital.

Q2: What financial instruments are commonly used for green financing?

A2: The main instruments include green bonds, sustainability-linked loans, and sustainability-linked financing, in line with international standards such as the Green Bond Principles (GBP).

Q3: What are the credit risk benefits of green borrowers?

A3: Green borrowers have a 32% lower default rate, improving credit quality, reducing capital costs, and enhancing investor confidence.

Q4: Are there notable international examples of green financing?

A4: Yes — Asia Green Real Estate (Asia) manages sustainable property funds; Absa Bank (South Africa) received USD 236 million in green financing from IFC; FIBRA Macquarie (Mexico) raised USD 150 million for green industrial zones.

Q5: How does ARDOR Green contribute to projects in Vietnam?

A5: ARDOR Green supports the integration of green standards (LEED, LOTUS, EDGE) from the design phase, assists with reporting processes, and helps developers access international green capital while reducing long-term regulatory risks.

Latest news

Special Highlights of COP30: When the World Looks to the Amazon for Climate Action of the Future

COP30 marks the 30th Conference of the Parties to the UNFCCC (United Nations Framework Convention on Climate Change).

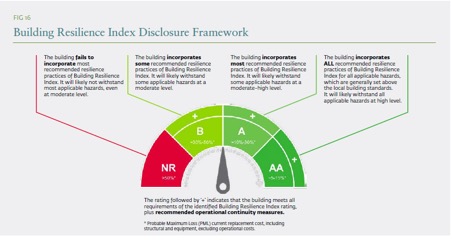

Criticality Assessment: The First Step Toward Building Resilience

Europe is entering a major transformation in resilience thinking. Under the Critical Entities Resilience (CER) Directive, organizations are not only required to manage risks but also to understand, demonstrate, and maintain the elements that are “critical” to their operations, economy, and society.

Carbon Trading Systems and the Reshaping of the Construction Industry’s Future

The construction industry is one of the largest sources of greenhouse gas emissions, accounting for around 37% of total global CO₂ emissions (IEA, 2022). The expansion of Emissions Trading Systems (ETS) beyond the energy sector into carbon-intensive industries — including building materials and operational processes — is reshaping the entire cost structure and competitive strategies of the construction sector.

LCA and EPD: Scientific Evidence for Transparency in Green Certifications

In today’s global context of increasing focus on sustainability, transparency in data has become a critical requirement in the construction industry. Two prominent tools that address this need are LCA (Life Cycle Assessment) and EPD (Environmental Product Declaration). Beyond helping projects earn credits in green building certification systems such as LEED or BREEAM, LCA and EPD are also long-term strategies to enhance credibility and value for projects.

ARDOR Green is recruiting the next generation of sustainable architects/engineers at the Bach Khoa Career Fair

Founded in 2005, ARDOR Architects has over 20 years of experience in architectural and urban planning consultancy, with participation in more than 150 projects and numerous international awards such as Top 10 Architects Ashui (2017) and BCI Asia Awards (2009, 2015, 2021).

From Commitment to Implementation of ESG in Vietnamese Enterprises

In today’s global context, ESG (Environmental – Social – Governance) is becoming a “new passport” for businesses. It is not only a factor that international investors and partners consider when cooperating, but also a competitive standard within global supply chains.

Build Green, Build with ARDOR Green